Are You Entitled to Unclaimed Property Held by the State of Michigan? Find Out Now – It Could Be Millions! You're Welcome Kalamazoo!

Did you know the State of Michigan is actively holding millions of dollars in unclaimed property for its residents? This isn't a myth or a scam; it's a legitimate program designed to reunite individuals, families, and businesses with their forgotten financial assets. Much of this money is simply waiting to be claimed by its rightful owners, and you might be one of them.

Did you know the State of Michigan is actively holding millions of dollars in unclaimed property for its residents? This isn't a myth or a scam; it's a legitimate program designed to reunite individuals, families, and businesses with their forgotten financial assets. Much of this money is simply waiting to be claimed by its rightful owners, and you might be one of them.

Each year, countless financial assets are turned over to the state due to a variety of circumstances: forgotten bank accounts, uncashed checks, security deposits from old rentals, insurance proceeds, utility refunds, and even wages that were never collected. If you've ever lived, worked, or conducted business in Michigan, there's a significant chance you could be entitled to funds without even realizing it.

The truly good news? Checking for unclaimed property in Michigan is not only free but also quick, secure, and entirely official through the State of Michigan's dedicated Department of Treasury website. There are no hidden fees, no middlemen required, and no complicated processes designed to deter you. It's a straightforward path to potentially recovering money that is already yours.

Ready to Discover Your Unclaimed Funds?

Don't let your money sit unclaimed. A quick search could reveal forgotten assets.

(This link takes you directly to the official State of Michigan website)

What Exactly Is Unclaimed Property in Michigan?

Unclaimed property (sometimes referred to as abandoned property) is a term for financial assets that have had no owner-initiated activity or contact for a specified period of time, typically ranging from 3 to 5 years, depending on the asset type. When businesses, financial institutions, or other entities lose contact with the rightful owner, and their attempts to re-establish contact are unsuccessful, they are legally required to transfer those assets to the Michigan Department of Treasury for safekeeping.

This process is governed by "escheat" laws, which are state laws that dictate how unclaimed property is handled. The primary purpose of these laws is to protect consumers by ensuring that these assets are not simply absorbed by the companies holding them, but rather held in trust by the state until the rightful owner or their heirs can be found. The Michigan Department of Treasury acts as a custodian, holding these funds indefinitely.

Common Examples of Michigan Unclaimed Property

The range of assets that can become unclaimed property is surprisingly broad. Here are some of the most common examples that Michigan residents might find:

- Forgotten Checking or Savings Accounts: Bank accounts that have seen no activity for several years.

- Uncashed Payroll or Refund Checks: Wages, vendor payments, or customer refunds that were never deposited.

- Security Deposits from Former Rentals: Deposits held by landlords that were never returned after a tenant moved out.

- Insurance Benefits or Refunds: Life insurance proceeds, policy refunds, or uncashed claims checks.

- Safe Deposit Box Contents: Items of value stored in safe deposit boxes where rental fees have gone unpaid and the owner is unreachable.

- Utility Overpayments: Refunds from utility companies for overpaid bills or deposits.

- Stocks, Bonds, and Mutual Funds: Securities where dividends or statements have gone unacknowledged.

- Court-Ordered Refunds or Settlements: Funds from class-action lawsuits or other legal proceedings.

- Trust Funds or Estates: Distributions from trusts or estates that could not be delivered to beneficiaries.

- Gift Certificates or Store Credits: In some cases, unused balances on gift cards or store credits can become unclaimed property if they meet certain criteria.

It's crucial to understand that these assets remain the property of the original owner—or their legal heirs—forever. In Michigan, there is no deadline or statute of limitations to claim them. The state holds these funds in perpetuity, waiting for you to come forward.

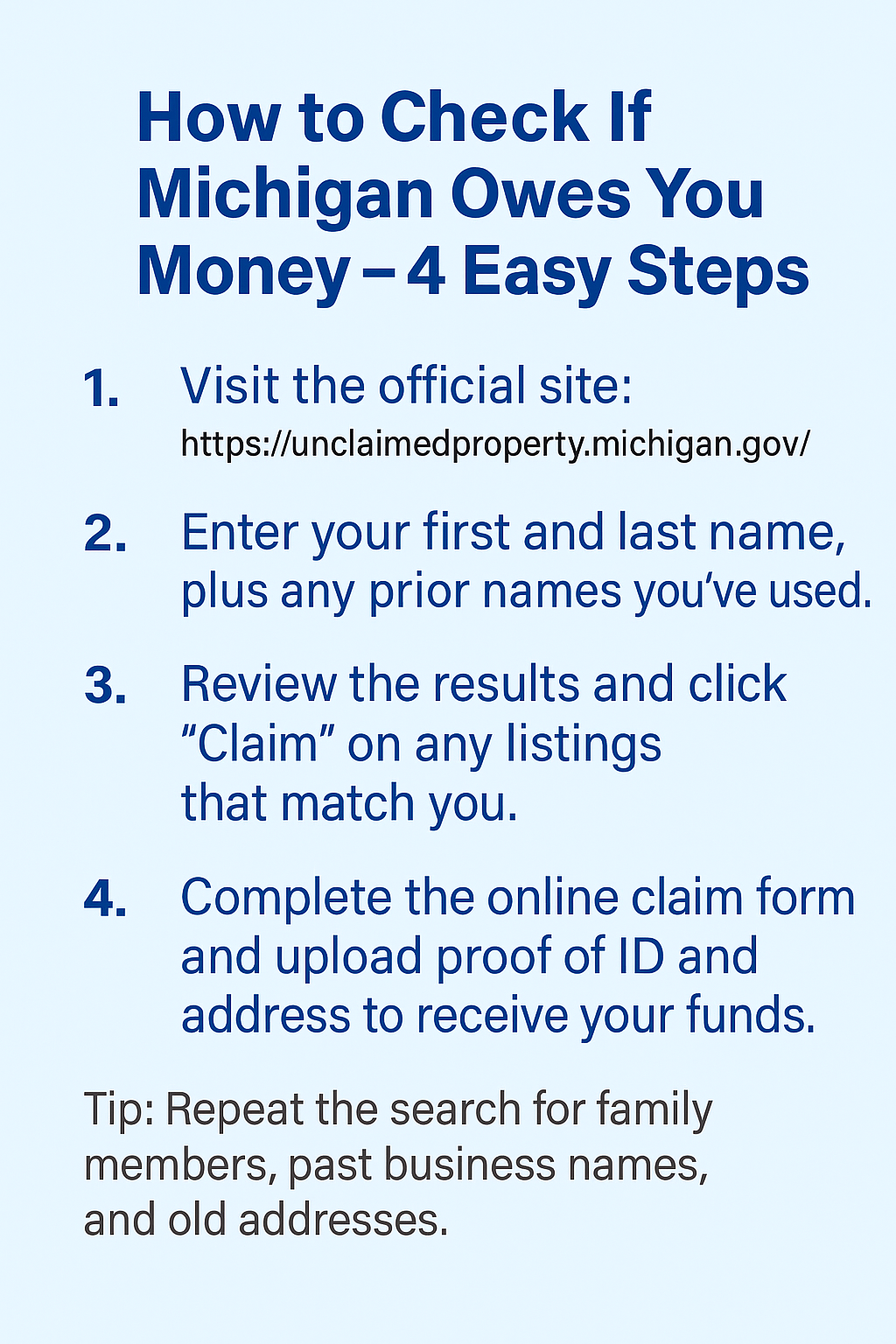

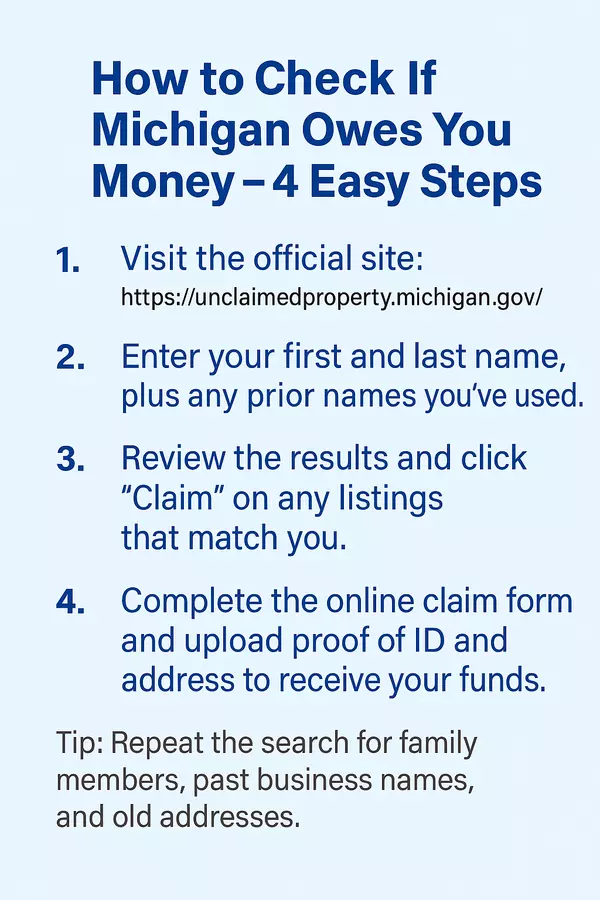

How to Search for Michigan Unclaimed Property: A Step-by-Step Guide

The process of searching for and claiming your Michigan unclaimed property is designed to be user-friendly and accessible. To see if you’re owed money, your first and most important step is to visit the official Michigan unclaimed property website:

👉

Step 1: Search Your Name (and Variations!)

The search function on the Michigan Treasury website is robust, but its effectiveness depends on how thoroughly you search. When entering your information:

- Your Current First and Last Name: This is the most obvious starting point.

- Maiden Names or Previous Surnames: If you've ever changed your name due to marriage, divorce, or other reasons, search using all previous legal names.

- Business Names: If you owned a sole proprietorship, partnership, or any other business entity, search using the full legal name of the business.

- Family Members: Search for deceased relatives, parents, grandparents, or even former spouses. Often, heirs are entitled to unclaimed property.

- Try Variations and Partial Spellings: Names can be misspelled by reporting businesses. Try common misspellings, initials, or even just your last name to broaden the search. For example, "William Smith" might be listed as "Wm Smith" or "Bill Smith."

- Former Addresses: While the primary search is by name, knowing former addresses can help you identify relevant listings if you have a common name.

The key here is thoroughness. Don't just search once and give up. Think of every possible name or entity under which you or your family might have had financial dealings.

Step 2: Review Matching Listings Carefully

Once you perform a search, the system will display any potential matches. Each result will typically show:

- The Reporting Business: This is the company or entity that originally held the funds (e.g., "Bank of America," "Consumers Energy," "ABC Insurance Co.").

- City or Last Known Address: This helps you determine if the property is likely yours, especially if you have a common name. It might be an old address where you once lived or worked.

- Property Type: This indicates the nature of the unclaimed asset (e.g., "Checking Account," "Utility Deposit," "Wages," "Insurance Proceeds").

- Amount (sometimes): While often not displayed for security reasons, some listings might indicate a range or a specific amount. Even small amounts are worth claiming—and multiple listings may apply to you or your family.

Take your time to review each listing. Even if the amount seems small, it's still your money. Furthermore, you might have multiple unclaimed properties from different sources, so don't stop at the first match.

Step 3: File a Claim Online

If you find a match that you believe belongs to you or a deceased family member:

- Click "Claim": There will be a clear button or link next to the listing to initiate the claim process.

- Complete the Secure Online Form: You'll be guided through a series of questions to provide your current contact information and details about your connection to the unclaimed property. This form is secure and designed to protect your personal data.

- Upload Any Required Documentation: To verify your identity and your right to the property, you will need to upload supporting documents. Most claims require simple proof such as:A photo ID (e.g., driver's license, state ID, passport).Proof of address (past or present, matching the address on the listing or showing your connection to it, e.g., utility bill, bank statement).For claims on behalf of a deceased person, you'll typically need a death certificate and proof of your legal right to the estate (e.g., letters of administration, will, affidavit of heirship).For business claims, proof of ownership or authorization to act on behalf of the business.

Ensure all documents are clear, legible, and accurately reflect the information provided in your claim. The more complete and accurate your submission, the faster your claim can be processed.

Step 4: Receive Your Money

Once your claim has been submitted and all required documentation is received and verified, the State of Michigan will review it. If approved, the Department of Treasury will issue payment—typically by check mailed to your provided address. Processing times can vary depending on the complexity of the claim and the volume of submissions, but many straightforward claims are completed within a few weeks.

You will usually receive updates on the status of your claim via email or through the online portal. Patience is key, but rest assured that the state is working to return your funds.

Key Benefits of the Michigan Unclaimed Property Program:

- No fees: You never pay to search or claim your property.

- No middlemen required: Deal directly with the State of Michigan.

- Direct from the State of Michigan: A secure and official process.

Why Michigan Residents Often Miss Unclaimed Property

It's a common question: if this money is mine, why don't I know about it? Many people never realize they’re owed money for a variety of understandable reasons:

- Frequent Moves and Forgotten Accounts: People move for jobs, family, or lifestyle changes. An old bank account, utility deposit, or refund check from a previous address can easily be forgotten or lost in the shuffle.

- Uncashed Checks: A small refund check, a final payroll check, or a dividend check might have been misplaced, overlooked, or simply never made it to the recipient. Over time, these become stale-dated and are turned over to the state.

- Loved Ones Passing Away: When a loved one passes, their financial affairs can be complex. Assets like forgotten insurance policies, old savings accounts, or uncashed checks might be overlooked during estate settlement, leaving funds behind for heirs to discover later.

- Rental Security Deposits: Tenants often move out and forget about a security deposit, or there might be a dispute that leads to the deposit being held and eventually escheated.

- Business Closures or Mergers: When a business closes, merges, or is acquired, final payments, refunds, or outstanding credits can be lost in the transition, leading to unclaimed property for former customers or employees.

- Lack of Awareness: Many people simply aren't aware that such a program exists or that the state holds these funds indefinitely.

This phenomenon is especially common among certain demographics:

- Homeowners who have sold property: Often forget about utility deposits or escrow refunds from previous homes.

- Renters who moved frequently: Accumulate multiple forgotten security deposits.

- Small business owners: May have old vendor credits, customer overpayments, or forgotten accounts.

- Heirs and estate beneficiaries: Often discover assets belonging to deceased relatives years after their passing.

- Individuals who have changed jobs multiple times: May have uncashed final paychecks or forgotten retirement contributions.

Common Misconceptions About Unclaimed Property

Despite the clear benefits, several myths persist about unclaimed property that can deter people from searching:

- "It's a Scam": This is perhaps the most common misconception. While there are scams related to unclaimed property, the official Michigan Treasury website is legitimate and secure. Always go directly to the state's official site.

- "It's Too Much Hassle": The process has been streamlined significantly. While some documentation is required, it's generally straightforward, especially for individual claims.

- "My Property Expired": In Michigan, unclaimed property never expires. The state holds it in trust indefinitely until the rightful owner or their heirs claim it.

- "It's Only for Large Amounts": Many people find small amounts, but these add up. And sometimes, people are surprised to find significant sums they never knew existed.

- "I Would Have Been Notified": While companies are required to attempt to notify owners, these attempts often fail due to outdated addresses or contact information.

What Happens to Unclaimed Funds in Michigan?

When property is turned over to the Michigan Department of Treasury, it is held in a special trust fund. The state acts as a custodian, safeguarding these assets until they can be returned to their rightful owners. It's important to reiterate that the state does not take ownership of the property; it merely holds it in trust.

While the funds are held, they may be invested, and the earnings from these investments can be used to support various state programs. However, the original principal amount remains available for claim by the owner or their heirs at any time, without any deadline. This system ensures that the money is protected and available for recovery, while also providing a benefit to the state in the interim.

Preventing Your Property from Becoming Unclaimed

While the state's program is a great safety net, the best approach is to prevent your property from becoming unclaimed in the first place. Here are some proactive tips:

- Keep Detailed Records: Maintain a centralized file (physical or digital) of all your financial accounts, insurance policies, investments, and safe deposit boxes.

- Update Contact Information: Whenever you move or change your name, notify all financial institutions, utility companies, and insurance providers.

- Regularly Review Statements: Open and review all financial statements promptly. If you stop receiving statements, investigate why.

- Cash Checks Promptly: Deposit or cash all checks as soon as you receive them.

- Communicate with Beneficiaries: Ensure your beneficiaries know about your assets and where to find information in case of your passing.

- Consolidate Accounts: If you have many small, inactive accounts, consider consolidating them to make them easier to manage.

- Set Reminders: For accounts you don't use frequently, set calendar reminders to make a small transaction or contact the institution annually to keep the account active.

Why Checking Unclaimed Property Matters for Homeowners & Sellers

As a real estate professional, I often encourage clients to check Michigan unclaimed property, especially during significant life events. The connection between unclaimed funds and real estate transactions might not be immediately obvious, but it's incredibly relevant:

- Buying or Selling a Home: This is a prime time to clean up finances. Old utility deposits from previous residences, escrow refunds, or even forgotten bank accounts used for down payments could surface.

- Settling an Estate: When dealing with the estate of a deceased loved one, searching for unclaimed property is a critical step. Many estates overlook these hidden assets, which can provide unexpected relief to heirs.

- Cleaning Up Finances Before a Move: Whether moving across town or out of state, it's an ideal opportunity to tie up loose ends and ensure no money is left behind.

- Preparing for Retirement: As you plan for retirement, every dollar counts. Unclaimed funds can be a welcome boost to your retirement savings or provide extra cash for immediate needs.

Unclaimed funds can provide a welcome financial cushion, helping to offset various expenses associated with real estate and life changes:

- Closing Costs: These can be substantial when buying or selling a home.

- Moving Expenses: The cost of movers, packing supplies, and setting up a new household adds up quickly.

- Repairs or Renovations: Found money can be allocated to necessary home improvements or desired upgrades.

- Outstanding Bills: Use the funds to pay down debt or cover unexpected expenses.

It’s essentially found money that’s already yours, just waiting to be reunited with you. It can significantly ease the financial burden of major life transitions.

Maximizing Your Search: Expert Tips for Success

To ensure you conduct the most comprehensive search possible, keep these expert tips in mind:

- Search family members’ names, including deceased relatives. This is one of the most common ways people discover significant unclaimed property.

- Search former addresses and businesses you or your family were associated with.

- Re-check every year or two—new property is added to the database regularly as businesses report new unclaimed assets.

- Be cautious of paid services that offer to find your unclaimed property for a fee. The official State of Michigan site is always free. Never pay someone upfront to find your money.

- If you have a common name, use additional identifiers like former cities or reporting business names to narrow down results.

- Don't overlook small amounts. Even a $5 refund is still your money, and it could be one of several small amounts that add up.

Frequently Asked Questions

Q: How can I prevent my property from becoming unclaimed in the future?

A: To prevent your property from becoming unclaimed, maintain detailed records of all your financial accounts, insurance policies, and safe deposit boxes. Always update your contact information with financial institutions when you move or change your name. Regularly review your financial statements and cash checks promptly. Additionally, communicate with your beneficiaries about your assets, and consider consolidating accounts to make management easier. Setting reminders for inactive accounts can also help keep them active.

Q: Are there any fees associated with claiming unclaimed property in Michigan?

A: No, there are absolutely no fees associated with searching for or claiming unclaimed property in Michigan. The process is entirely free and managed directly by the Michigan Department of Treasury. Be cautious of third-party services that may charge fees to assist you in claiming your property, as these are unnecessary. Always use the official state website to ensure you are not incurring any costs.

Q: What types of assets can I find in Michigan's unclaimed property database?

A: The Michigan unclaimed property database includes a wide variety of assets. Common examples are forgotten bank accounts, uncashed checks, security deposits, insurance proceeds, utility refunds, stocks, bonds, and even contents of safe deposit boxes. Essentially, any financial asset that has had no owner-initiated activity for a specified period may be considered unclaimed property and can be found in the database.

Q: How often should I check for unclaimed property?

A: It is advisable to check for unclaimed property at least once every year or two. New properties are added to the database regularly as businesses report unclaimed assets. Additionally, if you experience significant life changes—such as moving, changing jobs, or settling an estate—it's a good time to conduct a search. Regular checks can help ensure you don’t miss out on any funds that may belong to you.

Q: Can I claim unclaimed property on behalf of someone else?

A: Yes, you can file a claim on behalf of someone else, such as a deceased relative. However, you will need to provide specific documentation, including a death certificate and proof of your relationship to the deceased, along with any legal documents that establish your right to inherit from their estate. The Michigan Department of Treasury provides guidance on the necessary steps and documentation required for such claims.

Q: What should I do if I suspect I have unclaimed property but can't find it online?

A: If you suspect you have unclaimed property but cannot find it through the online search, consider reaching out directly to the Michigan Department of Treasury's Unclaimed Property Division. They can assist you in your search and provide guidance on alternative methods to locate your assets. Additionally, ensure you are using all possible name variations and former addresses in your search to maximize your chances of finding any unclaimed funds.

Q: Is the Michigan Unclaimed Property program legitimate?

A: Yes, absolutely. It is a legitimate program run by the Michigan Department of Treasury to return forgotten financial assets to their rightful owners. Always use the official state website: unclaimedproperty.michigan.gov.

Q: How long does it take to receive my money after filing a claim?

A: Processing times vary. Simple claims with complete documentation can be processed in a few weeks. More complex claims, especially those involving estates or multiple heirs, may take longer. You can usually check the status of your claim online.

Q: What if I don't have all the required documentation?

A: Contact the Michigan Department of Treasury's Unclaimed Property Division directly. They can provide guidance on alternative forms of documentation or steps you can take to obtain the necessary records.

Q: Can I search for unclaimed property in other states?

A: Yes. Most states have their own unclaimed property programs. You can search for property across multiple states using the national database at , which is endorsed by the National Association of Unclaimed Property Administrators (NAUPA).

Q: What if I find property for a deceased relative?

A: You can file a claim as an heir. You will typically need to provide the death certificate, proof of your relationship to the deceased, and documentation showing your legal right to inherit from their estate (e.g., a will, letters of administration, or an affidavit of heirship).

https://unclaimedproperty.michigan.gov/

(Clicking this link will take you directly to the official State of Michigan Unclaimed Property website.)

Don't Leave Your Money on the Table!

It only takes a few minutes to search—and you may be genuinely surprised at what you find. This is your money, waiting to be claimed.

If you’re buying, selling, or planning a move in Michigan and want guidance beyond real estate—reach out anytime....Richard Stewart You're Kalamazoo Realtor 269-345-7000 Smart financial housekeeping goes hand in hand with smart property decisions. Ensuring all your assets are accounted for is a crucial part of a sound financial strategy, whether you're a first-time homebuyer or a seasoned investor.

This public announcement is being provided by:Richard Stewart, Real Estate Broker REO Specialists Llc Kalamazoo Michigan Phone: Website: https://richardstewart.com/

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "